Published on:

Topics:

Country:

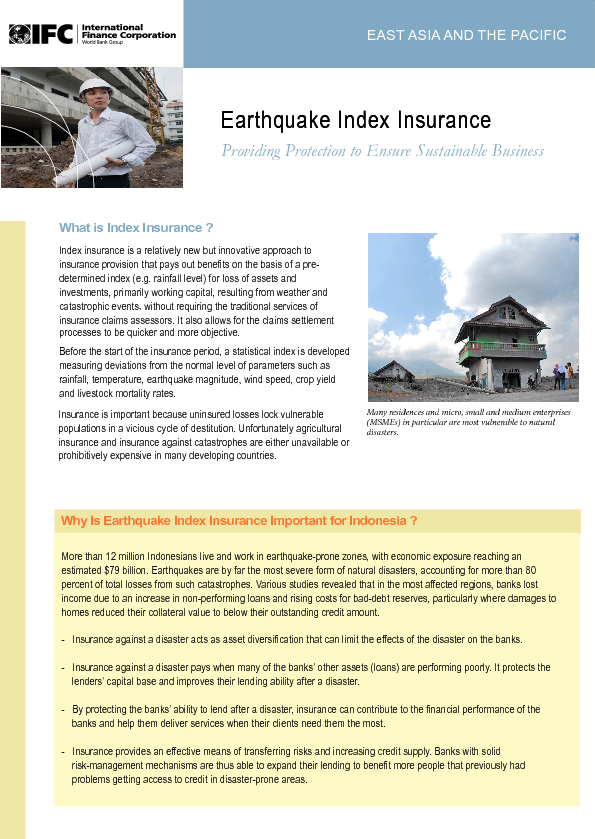

The International Finance Corporation (IFC) and specialist reinsurance company Reasuransi MAIPARK Indonesia have agreed to develop insurance products to help local farmers mitigate weather-related risks, Jakarta Globe reports. The agreement will establish insurance schemes that pay out benefits to farmers if a weather event exceeds levels in a predetermined index — which will measure rainfall levels, temperatures, wind speeds and crop yields, expected to provide cheaper and less complicated insurance benefits to farmers in the event of a natural disaster. "The region's changing climate has