10

Jul

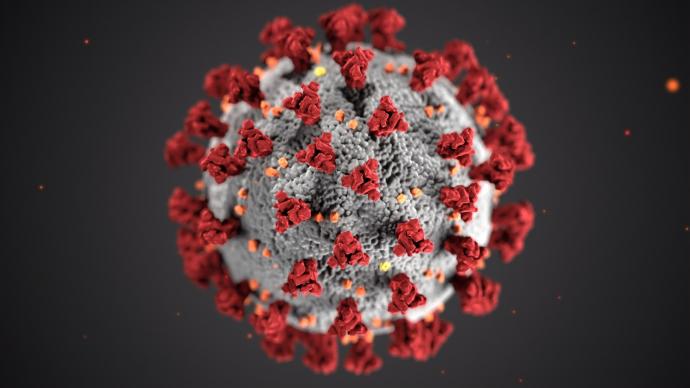

To understand the impact of COVID-19 on agriculture insurance operations, GIIF conducted a survey with 11 of its implementing partners in Sub-Saharan Africa and Asia. Due to the pandemic, the general feedback on policy renewal and new business generation for the agriculture business line offers a concerning outlook. Many expect a decrease in farmer enrollment due to diminishing disposable income and travel restrictions affecting field visits and in-person product awareness workshops. Likewise, limited mobility for project monitoring teams, crop cut specialists and aggregators as well as delays