“The Risk Modelling and Strategic Decision Making for Index Insurance” Technical Workshop

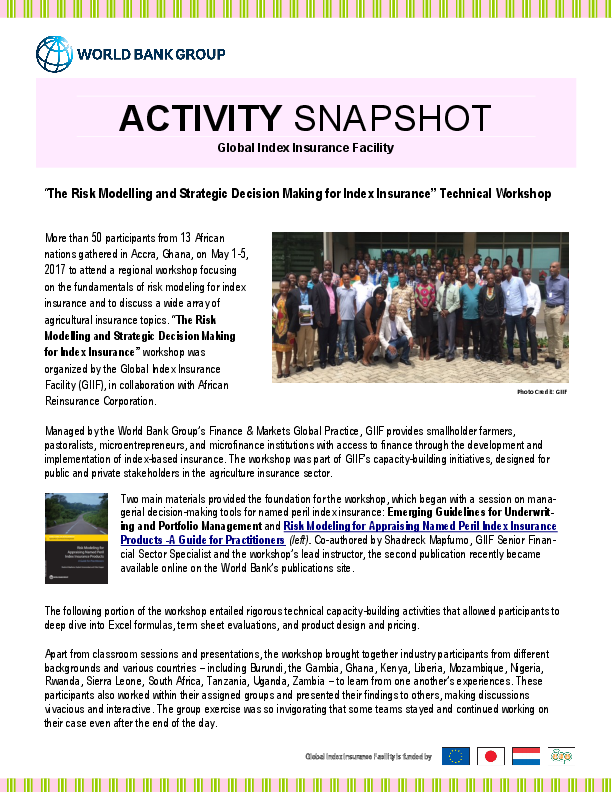

More than 50 participants from 13 African nations gathered in Accra, Ghana, from May 1-5, 2017 to attend a regional workshop focusing on the fundamentals of risk modeling for index insurance and to discuss a wide array of agricultural insurance topics. “The Risk Modelling and Strategic Decision Making for Index Insurance” workshop was organized by the Global Index Insurance Facility (GIIF), in collaboration with African Reinsurance Corporation.

Managed by the World Bank Group’s Finance & Markets Global Practice, GIIF provides smallholder farmers, pastoralists, microentrepreneurs, and microfinance institutions with access to finance through the development and implementation of index-based insurance. The workshop was part of GIIF’s capacity-building initiatives, designed for public and private stakeholders in the agriculture insurance sector.

Two main materials provided the foundation for the workshop, which began with a session on managerial decision-making tools for named peril index insurance: Emerging Guidelines for Underwriting and Portfolio Management and Risk Modeling for Appraising Named Peril Index Insurance Products - A Guide for Practitioners. Co-authored by Shadreck Mapfumo, GIIF Senior Financial Sector Specialist and the workshop’s lead instructor, the second publication recently became available online on the World Bank’s publications site.

The following portion of the workshop entailed rigorous technical capacity-building activities that allowed participants to deep dive into Excel formulas, term sheet evaluations, product design, and insurance pricing.

Apart from classroom sessions and presentations, the workshop brought together industry participants from different backgrounds and various countries – including Burundi, the Gambia, Ghana, Kenya, Liberia, Mozambique, Nigeria, Rwanda, Sierra Leone, South Africa, Tanzania, Uganda, Zambia – to learn from one another’s experiences. These participants also worked within their assigned groups and presented their findings to others, making discussions vivacious and interactive. The group exercise was so invigorating that some teams stayed and continued working on their case even after the end of the day.

“This workshop allowed not only knowledge sharing between the trainer and the participants but also the exchange of knowledge among members. The conversations continued even after the training hours. I encourage further training of regulators as this will allow them to understand the risks and benefits of index insurance,” said Christian Henning, Actuarial Specialist from South Africa’s Financial Service Board.

The importance of innovative insurance and capability-building to Africa’s agriculture sector was highlighted in a press release for the event. “The agriculture sector is a critical part of most economies in Africa and protecting farmers and agribusinesses from weather-related risks is critical, especially as the impacts of climate change become more pronounced,” said James Seward, Practice Manager for the World Bank Group’s Finance and Markets Global Practice, Africa region. “High-level training helps develop the skills to create new and innovative index-based insurance products in the regional market, which in turn will increase insurance penetration to rural and low-income markets in Africa.”

Okpo Bernard A.J. from Nigeria’s National Insurance Commission echoed the viewpoint: “The training is useful and timely because in Nigeria we are working on the approval of an index insurance product. Our country invests heavily in agriculture; it would be important for the development of index insurance to support our agricultural programs in the country.”

"The insurance industry needs more of this kind of capacity building activity, added Sainabou Jallow-Gaye, CEO of Takaful Insurance in the Gambia. “I think it will be useful as well to organize country specific workshops because I think we should look at index insurance development through the lens of country’s economic development of agricultural sector. “