Towards a global resilient recovery: Reflections on 2022

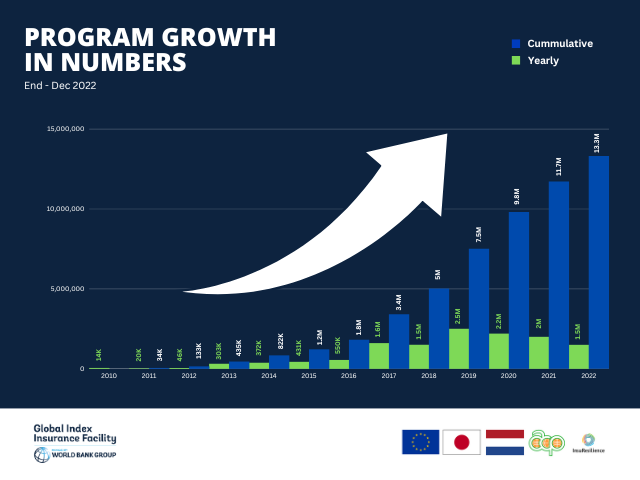

In 2022, despite the ongoing struggles of the COVID-19 pandemic, the GIIF Program successfully delivered significant results and continued building a strong pipeline to strengthen its ties with clients, other WBG projects and the donor community. All activities, projects, events, trainings, studies focus on further developing the markets. Since the launch of GIIF, more than 13 million agriculture insurance policies have been issued cumulatively, with an estimated outreach of 65 million beneficiaries globally. In these difficult conditions, as the GIIF team we would like to emphasize that we recognize and appreciate the commitment and hard work of our clients and colleagues, and we are grateful for the continuous support of our Donors.

Please see below a brief summary of activities that we would like to highlight under each category.

Project launches & Feasibility Studies:

- Feasibility studies in Angola, Malawi, Northern Nigeria, Kenya, and Zimbabwe: In Malawi, the study focuses on gathering an understanding of farmers' resilience thresholds, the drivers of such resilience, and the ideal level of insurance coverage needed to maintain the threshold. In Nigeria, the assessment is exploring the feasibility of using insurance in conflict zones for farmers and pastoralists. In Zimbabwe, the team supports the Insurance and Pensions Commission (IPEC) by conducting three analytical pieces: agricultural value chain study, an agricultural insurance market assessment and a review of the regulatory framework in the country. In Angola, the request of the insurance regulator aimed at launching agricultural insurance demand and supply side assessments, as well as delivering capacity building activities for market stakeholders. In Kenya, the team is exploring the viability of SME insurance solutions bundled with finance and other services provided to SMEs by various aggregators.

- The completion of the agricultural insurance diagnostic in Madagascar and the results dissemination workshop: The team is now involved in project implementation preparatory activities to form the design of a pilot project targeting 1-2 value chains.

- Project launches in Nigeria and Zambia to support market and firm level interventions to ramp up the outreach of inclusive insurance products.

Technical Assistance and Capacity Building Work:

- Kenya: Ongoing technical assistance to a non-profit corporation that offers agricultural insurance smallholder farmers. The support is to establish a regional insurance vehicle for smallholder farmers receiving credit from the organization, to offer more flexibility in coverage options, and to make the insurance process more time and cost efficient.

- India: The implementation of an agtech project, a follow up to the “Agriculture InsurTech Innovation Challenge” held in 2019. The objective of the Innovation Challenge was to identify several innovative ideas developed by startups to address challenges around agri insurance. The follow-up Agtech project organized its 1st agtech marketplace event in Delhi in December 2022. The goal with this India AgTech marketplace was to support scale-up for existing startups in their operations by bringing them on a single technological solution through a user-friendly, locally adapted user interface, with 24/7 customer support to reach a larger market.

Research Studies:

- The collaboration with Financial Sector Deepening Africa (FSD) on ‘the Neo Insurer Training Initiative (NITI)’ in Nigeria: This is a set of trainings with select incumbent insurance companies towards the development of a digital insurer and digital sandbox development concept in the country. Participants designed a roadmap for Innovation and Technology support required to drive scale particularly for Neo Insurers and assist insurance companies to validate assumptions of their Insurtech models and evaluate the most appropriate approach to drive penetration for insurance product offerings.

- Following the Agtech, Insurtech & Innovation Challenge in Kenya, the team worked on an enterprise acceleration and knowledge management (KM) initiative. The goal was to support the growth of SMEs working at the intersection of agriculture, insurance and climate in Africa. The KM products designed during this process include business models, blogs, case studies, enterprise marketing pitch material, all aimed at telling a story in enterprise acceleration development for rural populations.

- The South-East Asia insurtech mapping exercise, a follow-up to the Africa mapping study was done in collaboration with the IFC’s Fintech group. This market diagnostic and mapping exercise was conducted to support strategic business development in insurtech to know more about the insurtech ecosystem, emerging players and different business models in insurance companies. Following this exercise, the project team attended the Lome AFIS conference and the Indonesia Insurance Industry Gathering to present the outcome of this market diagnostic.

- The completion of a research study on understanding farmers’ adoption and utilization of agriculture insurance products in Kenya, Senegal and Zambia. Another research study to understand risk management needs of women farmers and WMSMEs in Nigeria and Zambia, in collaboration with the IFC Women’s Insurance Program was also completed.

Collaboration efforts with WB programs:

In addition to technical trainings to regulators, Ministries of Finance and other public sector practitioners, the team collaborates with World Bank colleagues on project implementation. Examples from joint work in 2022:

- Support to IPEC, the insurance regulator in Zimbabwe, in developing a regulatory framework that promotes an enabling environment for expanding the agricultural insurance market in the country. IFC is supporting IPEC on this activity, while the WB is supporting the regulator on activities related to the pensions side.

- Market wide technical support, to both public and private sector actors, in Nigeria and Zambia, to help expand the climate insurance market in these countries.

- Collaboration on the DRIVE project in the Horn of Africa with IFC’s role on providing technical capacity to insurance and reinsurance companies while the World Bank works on the regulatory component.

- The SMART Punjab project in Pakistan, with work focusing on the development of actuarial tool, training and capacity building.

- In DRC, GIIF supports the programmatic financial sector development work through Advisory Services & Analytics with a dedicated component on agri insurance. In 2022, the team conducted a feasibility study to examine the feasibility of developing a market-based agricultural index insurance program targeting small and medium scale farmers, possibly through a PPP between the Government and the domestic insurance industry. A National Committee on the Development of Agriculture Insurance (NCDAI) was established to oversee the implementation of the technical assistance. The team is now conducting a review of the insurance regulatory framework and developing draft insurance regulations covering micro insurance and index insurance.

Training: The organization of training sessions covering the principles of index insurance product design and evaluation in Kenya. The training brought together 24 participants from Zimbabwe, Zambia, Mozambique, Cameroon, Kenya, Nigeria, working in both (re)insurance companies, regulatory agencies and ministries of agriculture.

Knowledge Exchange:

- In March 2022, GIIF organized 2 virtual and 1 in-person session at the 2022 Africa Sankalp Forum in Kenya. Within this conference, GIIF also held an Agtech & Inclusive Insurance Competition with the participation of start-ups competing in 3 categories: data analytics, agricultural productivity, financial inclusion for Agriculture.

- A knowledge exchange session was organized at the 2022 Annual Insurance Conference in Zambia. The session presented a climate insurance case study from Indonesia, highlighting a model for successful collaboration between the insurance industry and an agribusiness/off-taker to develop solutions for smallholder farmers.

- In July 2022, a workshop in Madagascar took place to disseminate the results of the climate insurance demand assessment.

- Following the NITI trainings in Nigeria, the FSD organized a study tour to Kenya with the cohort who participated in the NITI initiative. The study tour took the delegates to Safaricom, APA Insurance, ACRE Africa, Insurance Regulatory Agency, and Kenbright Technologies, and focused on gathering real-industry experience in digital transitions from across Kenya’s insurance landscape.

- In May, GIIF organized a study tour to Senegal with the participation of delegations from DRC and Guinea. The goal was to meet with relevant stakeholders in Senegal and learn from their implementation experience and exchange knowledge on their next steps about conducting similar agriculture activities in their respective countries

- The Program hosted a knowledge exchange session at the 2022 International Conference on Inclusive Insurance, in Jamaica in October. The goal of the session was to discuss agriculture index insurance and the role of partnership in scaling up climate insurance, accelerating growth and economic viability in emerging markets.

- In Asia, GIIF attended a one-day consultation workshop on “Mobilising Open Data to power India’s Agri Stack” by the One CGIAR Digital Innovation & Digital Transformation (DI/DX) initiative, in partnership with The Agri Collaboratory. The goal was to contribute to the broader debate on the architecture of Agri Stack and on the specific data building blocks needed.