Pioneering Digital Transformation of Insurance Business in Sri Lanka -- An Interview with Kasundari Dissanayake, AAIB

You are here

The AAIB, Sri Lanka’s national agricultural insurer, partnered with the International Finance Corporation (IFC) to modernize agricultural insurance provision in the country. Kasundari, the Team Lead for the project, joined us to share their experience in digitizing agricultural information as part of this project.

Background

Imagine having to walk through a paddy tract consisting of hundreds of small fields in a rural area, sometimes without proper roads, seeking to identify a particular paddy of land. The mission is to verify an insurance claim in that field. For insurers offering traditional indemnity-based insurance products where individual loss verification is required to settle the claims, this process can be inefficient and cumbersome. Furthermore, it could lead to errors and moral hazard issues.

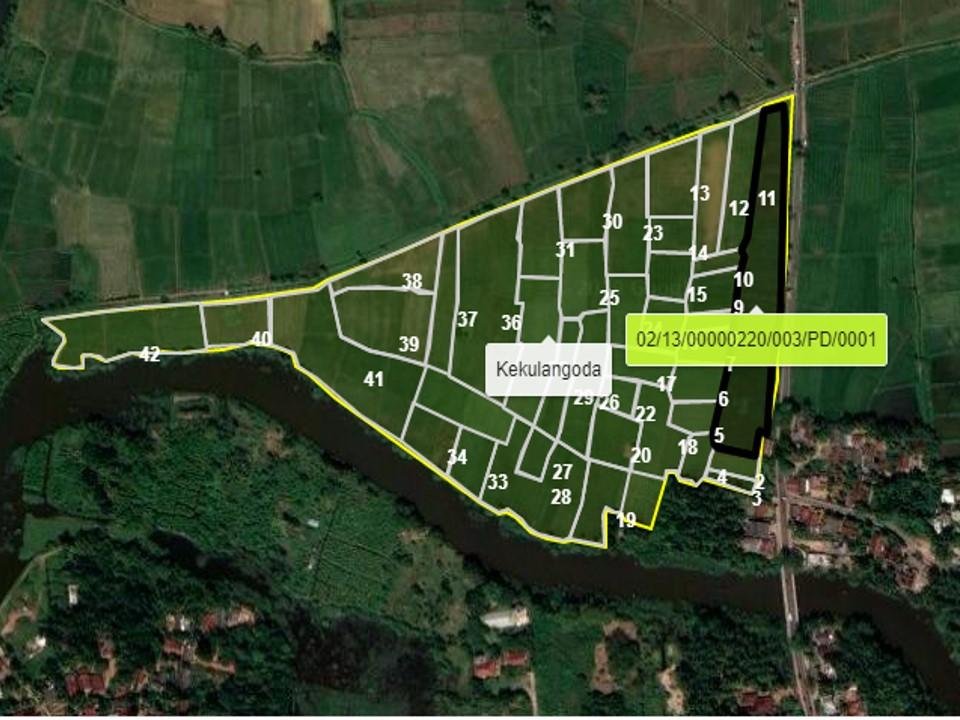

IFC’s project, funded by the Global Index Insurance Facility (GIIF), focused on modernizing the AAIB’s operations, improving its efficiencies and building a foundation for innovative products. It was in this context that the IFC team worked with the AAIB to conceptualize the development of a comprehensive agriculture database — a first for the country. A local firm specializing in geospatial mapping was selected to develop a customized web application linked to an insurance database for the AAIB’s farmer clients. The application uses satellite remote sensing and geographic information system (GIS) technology to map small farmland boundaries — another country first. The data capture process for the system is ongoing, and the first phase of testing has been completed.

GIIF: Could you please highlight some of the AAIB’s achievements and lessons learned in safeguarding agrarian communities?

Dissanayake:The AAIB is housed within the Ministry of Agriculture network. It is the only government institute that provides agricultural insurance solutions in Sri Lanka. It was established under the Agriculture Insurance Act of 1973. The AAIB has been focused on agriculture risk management and social security schemes for farmers.

Sri Lanka has experienced a high incidence of natural disasters, such as floods and droughts. In 2015, the government mandated the AAIB’s insurance scheme as compulsory for farmers. It also bundled the insurance with subsidized fertilizers. Since then, the insurance product had moved from different stages of pricing – moving from partially to fully subsidized. Currently, it is offered as a free insurance product.

In 2016, AAIB partnered with the IFC to modernize its insurance offering and improve efficiencies with the goal of providing Sri Lankan farmers with a better service. Considering the inherent issues in traditional agricultural insurance, the AAIB has made several attempts to improve and modernize its insurance offering.

GIIF: Could you please tell us about the progress and challenges regarding the Digitalization of Agriculture Insurance Project in Sri Lanka?

Dissanayake: The digitalization work is part of our overall project with the IFC, whereby we seek to introduce efficiencies through index insurance. The objective of the index insurance project is to introduce modern scientific methods for damage assessment. Data is key to providing index insurance. However, we lacked a comprehensive and accurate database of farmer information. Thus, it was imperative that we commenced digitization of farmer information to improve our service efficiency. Here, we appreciate the support of the IFC in piloting this initiative. Also, I am grateful to our Director General and management for providing us with the opportunity to engage in this project, which has proved to be a valuable learning experience.

The aim is to develop a comprehensive database linking farmer details and their lands with the geo-mapping of farmlands. We have commenced our pilot in 2 districts, mainly for paddy lands. Our goal is to “digitalize” our paddy land by the year 2022. The database will be maintained and updated seasonally to ensure that it is up to date and accurate. Moreover, there will be a monitoring platform whereby officers can upload their claim assessment photos of farm fields to the system. This will serve as a dual trigger for insurance claims.

Currently, we are working on data verification methods to improve data accuracy and reduce potential errors in data collection. In addition, more capacity building and training are needed for field officers. Such support would help them to gain a better understanding of geospatial mapping. Another challenge we face is resistance from some field-level officers in developing the geo-mapping process. Their input is needed to verify the land plot. Once completed, this effort will help to bring greater transparency to the system. Thus, the system has the potential to eliminate self-reporting biases.

GIIF: Could you please tell us about stakeholder engagement and involvement in this endeavor?

Dissanayake: Under this operation, the AAIB has engaged with various stakeholders in both the public and private sectors. The Ministry of Agriculture is very enthusiastic about this initiative. Our farmers are our main beneficiaries and the most important stakeholder group. Thus, special efforts were made to ensure the continuous engagement and training of field officers in the pilot districts, as they are the first point of contact with the farmers. Upon the completion of this project, we will work with the Ministry of Agriculture to identify methods of private sector engagement. We hope that this initiative will contribute to better information sharing and usage to improve market channels, logistics, production management and crop forecasting. Thus, this project aims to benefit the entire agricultural community in Sri Lanka.

GIIF: How would the digitalization of agricultural insurance impact the farmers’ lives and ways of doing business?

Dissanayake: Again, the objective of the overall program with the IFC is to improve the livelihood of our main customer, the farmers. The AAIB aims to provide a better and more efficient service with improvements in the insurance claims settlement process. The precision achieved through technology using the geographic information system (GIS) together with the comprehensive agricultural database will be of significant help in this process. We also plan to develop a mobile app linked to the database, whereby farmers will have better access to information from the government about agricultural-related matters.

The availability of a comprehensive database will provide an opportunity to link supply chains, markets, warehousing, and so on, thereby providing farmers with complete solutions for their farming needs. We look forward to a continued partnership with IFC in making this a reality.

Special thanks to Rathnija Arandara, Senior Financial Sector Specialist and Shanuki Gunasekera, Financial Sector Specialist for facilitating the interview.